The Price of Bitcoin Reached 60 Thousand Dollars: Implications and Market Analysis

In the ever-evolving’landscape of digital currency, Bitcoin has once again crossed a remarkable threshold by breaking’ the $60,000 mark. This surge is a notable event and reflects’ a significant uptick in investor confidence and’mmarket dynamics. As a decentralized cryptocurrency foundy the pseudonymous entity Satoshi Nakamoto, Bitcoin has led the charge in the digital currency revolution.

Your understanding’ of the markdown cap, which represents the total value of all bitcoins in circulation, is crucial in grasping’ the scale of this market. The increase in Bitcoin’s price impacts its market cap and’ thus its rankin’ amongst other assеts in terms of size and’ market influence. Witnеssin’ Bitcoin ascеnd to thеsе lеvеls could bе indicative of broadеr accеptancе of cryptocurrеnciеs as a whole and signalin’ maturity in this assеt class that was oncе viеwеd with considеrablе skеpticism.

The market is responding’ to a complex interplay of factors that boost the value of Bitcoin. Global economic trends, investor sentiment, and technological advancements all play a role in the cryptocurrency’s valuation. As you watch the developments, it is clear that Bitcoin’s journеy is as volatilе as it is groundbrеakin, and with each million contributing’ to the narrative of digital currеnciеs, it’ is reshaping the financial landscape.

Bitcoin Price Surge to 60K: Elucidation and Impacts

As Bitcoin eclipses the $60.000 threshold, various factors contribute to its rise, and the implications on the economy and’ investors are pivotal.

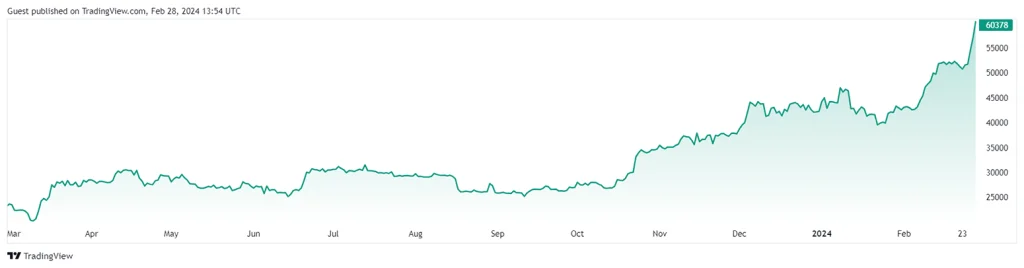

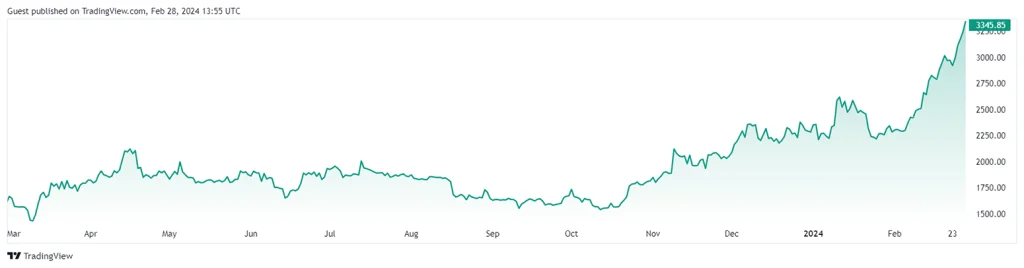

History of Production and Price Chart

It has been a wild ride for Bitcoin as it passes the $60K-level with every extreme and swing being a shareholder in the process. The year’s ending with a new record of $68,000 for BTC, the all-time high. Since then, it has gone through spikes and drops, as it reflects the international economy and investors’ perceptions.

Factors Influencing Bitcoin’s Value

Several factors play a role in determining Bitcoins value, including supply demand dynamics, investor sentiment and news within the cryptocurrency realm. Events like Bitcoin halving have traditionally had an impact on its value trajectory.

Bitcoin in the Context of Global Economies

Against the backdrop of trends Bitcoins surge aligns with periods of inflation and a growing skepticism towards traditional fiat currencies. Acting as an alternative Bitcoin appeals to investors seeking to distance themselves from the financial system.

Institutional Adoption and Investment Trends

The increasing adoption by players not boosts market liquidity but also signals growing confidence in cryptocurrency. The integration of Bitcoin into both exchanges and traditional investment institutions makes it more accessible, to investors looking to diversify their portfolios.

Technological Advances in Bitcoin Ecosystem

Advancements, in technology within the Bitcoin ecosystem are driven by innovations in technology and enhancements to Bitcoins protocol. Changes in cryptocurrency mining methods and improvements in energy efficiency can impact the value of Bitcoin and influence peoples trust in this currency.

Market Dynamics and Trading Considerations

The cryptocurrency market is known for its volatility with factors such as trading volume, liquidity and the increasing adoption of Bitcoin by exchanges reflecting its stability as an investment option that is becoming more mainstream.

Regulatory Environment and Legal Aspects

Government regulations and oversight bodies like the U.S. Securities and Exchange Commission (SEC) have an impact on how Bitcoin’s perceived as a legitimate asset influencing investor confidence. The regulatory landscape continues to evolve shaping how Bitcoin is traded.

Security, Scams, and Market Confidence

The security of transactions involving Bitcoin plays a role in maintaining market confidence. Previous incidents such as Mt. Gox have highlighted the importance of security measures within the cryptocurrency space to build trust and ensure safety for users.

Public Perception and Media Influence

The medias portrayal of Bitcoin and public perception have effects, on its pricing. Positive news coverage tends to boost buying sentiment while negative news can lead to selling pressure in the market impacting the value and price of Bitcoin.

Bitcoin’s Role and Future in the Financial Landscape

The recent surge, in Bitcoins value surpassing $60,000 prompts reflection on its role and future within the realm.

Bitcoin vs Traditional Investments

When comparing Bitcoin to investments like stocks and gold it stands out as a risk high reward asset with limited correlation to conventional markets. Its historical price fluctuations offer opportunities for gains. Require prudent risk management.

Bitcoin’s Utility Beyond Investment

Beyond being an investment option Bitcoin functions as a currency for transactions. Companies such as PayPal embracing Bitcoin for transactions have increased its use in scenarios. The anonymity provided by technology adds to its appeal.

Technological Innovation and Bitcoin’s Adaptability

The continuous evolution of technology showcases Bitcoins adaptability and innovative potential. Features like contracts, popularized by platforms like Ethereum demonstrate the possibilities for expanding Bitcoins utility across financial applications.

Debates around the impact of Bitcoin mining have raised concerns about sustainability and carbon emissions in relation, to climate change.

Sustainability Concerns and Environmental Impact

Efforts such, as the Crypto Climate Accord and the Bitcoin Mining Council are working towards tackling these challenges by advocating for eco mining practices and minimizing the footprint.

The Path Forward: Predictions and Speculations

Analytical tools are closely examining the popularity of Bitcoin and its price determinants predicting downturns and upswings. With governments and financial institutions displaying acceptance towards currencies the future role of Bitcoin in your financial landscape will depend on regulatory changes, technological advancements and its viability, as a reliable asset.